- Home

- Blog

Blog

We produce articles that cover topical or important developments in tax. If you wish to receive a notification when these are published please subscribe for updates.

We also publish links to blogs via our LinkedIn profile, please follow us if you would prefer to read them in your feed.

All of our blog posts are displayed below with the most recent first.

Research and Development (R&D) tax relief remains a key incentive for innovative small and medium-sized enterprises (SMEs) in the...

December 24, 2025

Government Waters Down Limitations on Inheritance Tax Relief for Business Owners and Farmers

In the Budget of 30 October 2024 the Government announced plans to limit full Business Property Relief and Agricultural Property...

December 2, 2025

Year-End Tax Planning for Americans Living in the UK: Key Considerations for 2025

When writing about this topic last year, we noted how 2024 was one of the most eventful years for tax changes and elections....

November 26, 2025

Autumn Budget 2025 - Personal Tax Update

Earlier today the Chancellor Rachel Reeves delivered the Autumn Budget 2025. Our Private Client tax team shares their summary of...

November 11, 2025

Thinking of Relocating? How Malta’s Tax Rules Benefit British Expats

Our tax partner, Jamie Favell, was recently featured in The Times, offering expert insights on a rising trend: more British...

November 4, 2025

UK Exit Tax on the Horizon?

The UK government is reportedly weighing a major change to its capital gains tax regime: an Exit Charge, referred to in the press...

October 31, 2025

Halloween at TAP

We are pleased to share some festive news from our Leeds office team. Talia Lockwood from the Leeds office recently secured...

October 29, 2025

Why HMRC Rejects 'Whole Car' R&D Claims and Demands Granular Project-Level Submission

When preparing HMRC R&D tax credits claims, it is crucial to understand that HMRC evaluates research and development activities...

October 14, 2025

R&D Tax Relief in Football: Innovation or Controversy?

Research and Development (R&D) tax relief is intended to encourage companies to invest in pioneering technological and scientific...

September 24, 2025

R&D Tax Relief in 2025: What Every Innovative Business Needs to Know Now

The UK’s research and development (R&D) tax relief landscape underwent its most significant overhaul in years starting April 1,...

September 17, 2025

One Budget to Rule Them All: The 2025 Budget’s Hunt for Revenue

As the Chancellor of the Exchequer gears up to announce her second Budget on 26 November 2025, with talk of a further £50bn...

September 15, 2025

Temporary Non-Residents Targeted by HMRC: What You Need to Know

Recently, HMRC has been reaching out to taxpayers who were 'temporarily non-resident' in the UK and may not have fully declared...

July 24, 2025

Inheritance Tax – The Dilemma

Growing Interest in Life Insurance for Inheritance Tax (IHT)

July 21, 2025

31 July Tax Deadline – Don’t Overpay

The second Self Assessment payment on account is due soon, with the deadline falling on 31 July. If you’re required to make...

June 5, 2025

Claim Notification Form & R&D Tax Relief UK: Key Deadline June 30, 2025

Claim Notification Form: What UK Businesses Must Know About R&D Tax Relief Deadlines

June 4, 2025

Family Investment Companies: The New Strategy for Wealth Protection?

Family Investment Companies: The New Strategy for Wealth Protection?

May 28, 2025

Non-Dom Reform 2025: Impact on UK Tax and Residency Status

Leaving the UK But Still Tax Resident?

May 12, 2025

STBV (Short-Term Business Visitor) Reporting Due by 31st May

When is an STBV agreement required?

April 7, 2025

A FIG from the Ashes – A New Era for International Private Client Tax

A Turning Point for UK Tax

April 4, 2025

Snitches Get... Riches: Chancellor to Incentivise Whistleblowing to Clamp Down on Tax Evasion

In last week’s Spring Statement, Rachel Reeves announced the government’s intention to clamp down on tax evasion, including novel...

April 2, 2025

April Action Required for All Employers With Active Section 690 Directions

In their March bulletin issued to agents, HMRC confirmed that, along with the expected changes to the taxation of non-domiciled...

March 31, 2025

Understanding the Latest Changes in R&D Tax Relief Advance Clearances: What Businesses Need to Know

The UK Government’s consultation on widening the use of advance clearances for R&D tax credits aims to combat error and fraud,...

March 24, 2025

Act Now to Fill Gaps in National Insurance Contributions (NIC) Record

If you make sufficient years of National Insurance Contributions (NIC) in the UK you will qualify for a State Pension. You need...

March 21, 2025

HMRC Make Gains On Undeclared Capital Gains Tax

It was reported in the press this week that HMRC has increased its activity in investigating underpaid capital gains tax (CGT)....

March 20, 2025

The Bewildering Benefits of Future Technology within a Professional Business Environment

Oliver Favell recently joined TAP for a day of work experience. During his time with the team, Ollie shared valuable insights...

March 13, 2025

Navigating Tax Residency: Dual Residency, DTAs & Non-Residency Benefits

The Changing World and Tax Residency Challenges

March 11, 2025

VAT Compliance in an Expanding EU Market

With more businesses than ever expanding into the EU, VAT compliance has become a critical challenge.

March 5, 2025

Spring Statement 2025 – Private Client Forecast

The Spring Statement will take place on Wednesday, 26 March 2025, in the House of Commons.

January 31, 2025

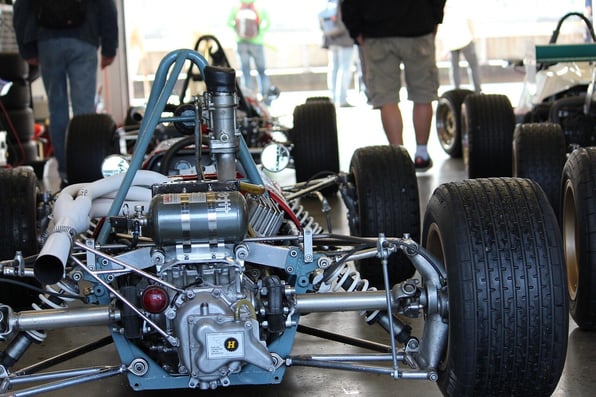

The Motorsport R&D Race: Innovation, Technology, and the Future

The motorsport industry is at the forefront of research and development (R&D), constantly pushing the limits of technology and...

January 30, 2025

Parents Rush to Transfer Family Homes to Avoid Inheritance Tax

Recent analysis reveals a significant trend among parents who are hastily transferring ownership of their family homes to their...

January 24, 2025

Chancellors last ditch attempt to woo non-doms

In the wake of news that a significant number of non-doms are leaving the UK, a somewhat surprised Chancellor Rachel Reeves has...

January 9, 2025

US Tax Planning 2025

Having entered into 2025, we will soon see the Republicans form a new US government with the shy and retiring Mr D Trump at the...

November 17, 2024

How does the abolition of the non-dom regime affect US citizens in the UK?

The 2024 Spring Budget introduced major changes to the taxation of non-UK domiciled individuals. The new Labour government’s...

November 14, 2024

Hidden Impact of Pensions becoming subject to Inheritance Tax

One of the biggest losers in the recent Autumn Budget was the personal pension pot left to the beneficiaries of an estate. But,...

November 6, 2024

The Return of the Donald

It’s official, Donald Trump will return to office on 20 January when he will, again, be inaugurated as US President.

October 30, 2024

Autumn Budget 2024 - Business headlines

Earlier today the Chancellor Rachel Reeves delivered her first Autumn Budget 2024. Our Corporate tax team share their summary of...

September 19, 2024

Tax Case Tests Dual Residency Tie-breaker Tests

We advise a lot of clients on their UK tax resident status and also, in cases where they are dual resident, we assist them in...

September 16, 2024

UK's Wealthy Taking Flight to Save Tax

It is being widely reported in the UK press that UK taxpayers are leaving the UK due to the tax changes coming into force from 6...

September 4, 2024

CIOT Response to Carried Interest Consultation

On 29 July His Majesty’s Treasury (HMT) made a request for stakeholders to provide evidence and comments on proposals to reform...

August 17, 2024

Selling goods via online platforms

This article is to make you aware of a new tax alert issued by HMRC which confirms they are targeting those who sell goods and...

August 15, 2024

HMRC Target Crypto Gains

If you own any crypto assets, it is important that you consider whether any gains realised have been reported correctly as these...

August 1, 2024

Policy statement on changes to non-dom tax regime

On Monday the new Labour Government published a short policy statement on the changes to non-dom tax regime. It was not...

July 8, 2024

Turning the page to the new Labour government

After 14 years of Conservative rule, Labour has taken the reins under Keir Starmer with a massive majority as the electoral map...

April 29, 2024

Fallout from proposed Non-Dom rule changes - Inheritance Tax

In their attempt to simplify and reduce the tax breaks currently available to non-UK domiciled individuals (Non-Doms), the...

April 28, 2024

Pandora Papers - Does this affect you?

Last year wrote about offshore income and gains letters being issued to taxpayers who were linked to the Pandora Papers. ...

March 7, 2024

Spring Budget 2024

The Chancellor Jeremy Hunt delivered his Spring Budget on Wednesday 6 March 2024. His focus was on updating the tax regime for...

December 19, 2023

Melton Mowbray pet food firm acquired by growing pet care business

Assisi Pet Care Ltd, the company behind Hollings, the suppliers of natural dog treats, has acquired family-owned Town & Country...

December 19, 2023

Selling UK Property While Living Abroad

Our private client Partner Jamie Favell recently caught up with Experts for Expats to discuss the tax issues faced by...

December 19, 2023

R&D Autumn Statement Impact

We have been made aware by the Chartered Institute of Taxation that, the UK tax authorities, HM Revenue and Customs (“HMRC”)...

December 19, 2023

Are you an “Accidental American” who has or is considering expatriating? If so, relief from all US taxes and penalties could now be available!

US persons are required to file annual US tax returns regardless as to where they are living. Our blog below refers and explains...

December 18, 2023

Cryptocurrencies - HMRC crackdown on disclosures of transactions

Exchange of information between tax authorities and Crypto platforms will lead to a more focussed approach from HMRC on unpaid...

November 24, 2023

Dealmakers Awards 2023

Yorkshire Dealmaker Awards 2023It was truly a privilege to once again be invited to attend the Yorkshire Dealmaker Awards last...

November 22, 2023

Autumn Statement 2023

The Chancellor Jeremy Hunt delivered his Autumn Statement on Wednesday 22 November 2023. His focus was on encouraging investment...

November 3, 2023

What are the Main Political Parties’ Election Tax Policies

What are the Main Political Parties’ Election Tax Policies?As we move towards 2024 and closer to the next General Election,...

October 12, 2023

HMRC Success Against Bernie Ecclestone

HMRC Success Against Bernie Ecclestone : What does this mean for those of us that aren't billionaires?Its been widely publicised...

October 9, 2023

New Pension Lump Sum and Death Benefit Allowance

New Pension Lump Sum and Death Benefit Allowance- Draft legislation will impact beneficiaries of death benefits that choose income

September 26, 2023

HMRC Send 23,936 Offshore Nudge Letters re 2022/23

HMRC continue to become aware of taxpayers who may be in receipt of income/gains from overseas assets via automatic exchange of...

August 6, 2023

Post Pandemic Residency Review

It is being widely reported in the press that HMRC are targeting individuals that have claimed non-resident status for UK tax...

August 1, 2023

7.75% Late Payment Interest - A sting in the tail

[UPDATED TO REFLECT BASE INCREASE ON 3 AUGUST 2023]

July 25, 2023

Wealth Tax Threat Continues

Following the Covid-19 pandemic which blighted the UK economy the Wealth Tax Commission were tasked with finding ways in which...

July 16, 2023

National Insurance Gap Extension

The normal time limit for a person to fill gaps in their national insurance (NI) record is six years, but transitional...

June 26, 2023

Pandora Papers - What were they and what if you were named in them?

The Pandora papers involved the release of millions of documents from a number of different offshore financial service providers,...

June 6, 2023

2023/24 - The 23-month tax year?

The government announced in the Autumn Budget 2021 that it would reform the way that trading profits are allocated to tax years...

May 22, 2023

Stay ahead and protect your business in the face of winding-up petitions

With HMRC under pressure to collect more tax owed, it is moving away from the tolerance shown during the pandemic and back...

April 26, 2023

Apprenticeships with TAP

We interviewed our apprentice, James, who joined us in 2021, to get an idea of what it's like to learn with TAP and give any...

April 10, 2023

No more (paper) tax returns

More than 12 million taxpayers file self-assessment tax returns, but less than 3% do so using a paper return. HMRC stopped...

March 15, 2023

Spring Budget 2023 - Time to invest

Earlier today the current Chancellor announced the Spring Budget 2023. Our Corporate tax team share their summary of the key...

March 15, 2023

Spring Budget 2023 - Personal tax

Earlier today the Chancellor of the Exchequer, Jeremy Hunt, presented the Spring Budget 2023. Our private client team summarise...

November 17, 2022

Autumn Statement - Summary

Earlier today the current Chancellor announced the latest Autumn Statement. Unlike the “fiscal event” announced 55 days ago by...

November 1, 2022

HMRC Target Offshore Companies

We have been made aware by the Chartered Institute of Taxation that, the UK tax authorities, HM Revenue and Customs (“HMRC”)...

September 22, 2022

Mini-budget key points

Today Kwasi Kwarteng presented his first budget and with a clear strategy, reduce taxes to stimulate growth! Some headline...

April 13, 2022

What is a Green Card?

Following on from the news surrounding Rishi Sunak’s wife non-domiciled UK tax status (read more about this here), it seems that...

April 6, 2022

Non-Domiciled - What is a Non-Dom and what is the Remittance Basis?

There has been a huge amount of press around the fact that Rishi Sunak’s wife, Akshata Murthy, is a “non-dom” and able to access...

March 24, 2022

Chancellor Announces additional R&D Tax Credit opportunities

In the Autumn Statement of 2021, the Government provided details on a series of measures to reform the R&D tax relief system....

October 26, 2021

Quid Game - Budget

The 2021 Autumn Budget was delivered today by The Host, the Chancellor of the Exchequer Rishi Sunak.

October 20, 2021

HMRC Target Crypto Owners

HMRC has warned taxpayers that hold crypto assets, that they should expect to be contacted to verify their tax affairs are in...

October 18, 2021

Political donations: an unexpected Inheritance Tax risk

An interesting recent case (known as Banks vs IRC) shows the need to take tax advice if you are considering making a political...

October 17, 2021

File online to avoid filing by 31st October

HMRC has reminded self-assessment taxpayers to ensure they have the correct information in order to complete their 2020/21 tax...

October 11, 2021

When is a house not a home?

Whether a property is residential or commercial for the purposes of Capital Gains Tax (CGT) has an impact on both the timing of...

October 3, 2021

TAP features again on eprivateclient's prestigious list

Today it has been announced that Tax Advisory Partnership (TAP) has again featured in eprivateclient’s prestigious Top...

October 2, 2021

A muted Budget?

The Chancellor’s forthcoming budget is only a few weeks away (27 October) and as usual there is plenty of speculation regarding...

September 22, 2021

CGT Hike Looming?

The Sword of Damocles hanging over UK investors is the continued threat of hikes in capital gains tax (“CGT”) rates. The rates of...

September 21, 2021

Biden's Big Tax Plan

In this blog from our US tax team, we look at President Biden’s plans for significant tax rises for both high net worth...

September 15, 2021

Overseas Workdays – What a Relief!

One of the most valuable tax reliefs available to expats working in the UK is Overseas Workdays Relief (“OWR”).Foreign national...

September 14, 2021

ATED Filing Obligations and Penalties…

Companies that own UK property are required to file annual ATED Returns (“Annual Tax on Enveloped Dwellings”) with HMRC.

September 12, 2021

HMRC issues damning impact statement on the new Health and Social Care taxes

Further to the government’s announcement on 7 September 2021 HMRC have now released their less than positive impact statement on...

September 9, 2021

Eclipse film partnerships landmark “tax amnesty” announced by HMRC

HMRC have announced a ground-breaking tax amnesty (known as a settlement opportunity) for current and former members of the...

September 6, 2021

Prime Minister announces dividend and NICs tax rate increase

Boris Johnson has today announced a 1.25% health and social care tax across the UK to help the NHS recover from the Covid...

September 6, 2021

TAP announce partnership promotions

We are delighted to announce the promotion of Helen Mallalieu and Sophia Passingham to Partnership within Tax Advisory...

September 6, 2021

Is Tax Evasion On The Rise?

A recent freedom of information request shows a slight drop in the number of reports of suspected tax evasion made by members of...

August 8, 2021

Footballers beware!

Football is currently providing rich pickings for HMRC as illustrated by a recent Freedom of Information request.

July 25, 2021

The “Super-deduction”: a valuable opportunity

We mentioned the new capital allowances “Super-deduction” briefly in our last Budget update but we thought it was worthwhile...

July 25, 2021

Self-employed tax consultation: a welcome development?

HMRC have launched a new consultation proposing changes to the tax treatment of the self-employed which will, if introduced, aim...

July 12, 2021

The deal of the century?

In previous blogs we have reported on the progress of proposals for a global minimum tax for very large multinationals. Things...

July 4, 2021

Progress of the global minimum corporate tax rate

In previous blogs we have reported on the progress of proposals for a global minimum tax for very large multinationals.

June 22, 2021

Chu-CHUNK!

Some of us remember the first time they scurried along to the dusty stamp office and hesitantly asked a gruff Inland Revenue...

June 21, 2021

Tax - in real time

The publication of the first consultation on the notification of uncertain tax treatments in advance of tax returns may have gone...

June 13, 2021

TAP shortlisted for Boutique Tax Accountant of the Year by eprivateclient

Today it has been announced that TAP have been shortlisted in the category of Boutique Tax Accountancy firm of the year in the...

June 8, 2021

A global minimum tax is on its way

In a recent blog we asked the question - is a global minimum tax for very large multinationals just pie in the sky? The answer...

June 6, 2021

Can you have your cake and eat it?

Recent press reports have focused on an Inheritance Tax (IHT) snare we commonly see arising in our practice; one which is costing...

May 25, 2021

A Global Minimum Tax Rate: is this just pie in the sky?

In a recent blog we reported that Amazon had won its fight against an EU judgement forcing it to pay about €250m in back taxes to...

May 17, 2021

It's end to end stuff Gary: IR35

A former England footballer so good he won the Golden Boot at the 1986 FIFA World Cup now finds himself mired in litigation with...

May 12, 2021

Why does Amazon’s gigantic tax case win matter to smaller firms?

Amazon has won its fight against an EU judgement forcing it to pay about €250m in back taxes to Luxembourg in a significant blow...

May 6, 2021

Are US personal tax rises on the way?

Are US personal tax rises on the way? It would be easy to become confused by the vast swathes of new legislation which have been...

March 4, 2021

Budget 2021 - Summary of key tax announcements

The Chancellor of the Exchequer has delivered a budget which contained little in the way of major surprises given that a lot of...

December 31, 2020

The UK's Tax return deadline is fast approaching

The UK’s personal tax Self Assessment return deadline is on 31 January 2021. The return covers the period starting on 6 April...

December 22, 2020

UK Budget Date Announced

For those who might have missed it, the Chancellor, Rishi Sunak has announced that the date for the next UK Budget will be 3...

December 15, 2020

A UK wealth tax?

The fact that the possibility, however remote, of a Conservative government introducing a one-off wealth tax is being discussed...

December 8, 2020

New Crown preference for tax debts

Despite fierce opposition to the measure, on 1 December 2020, the Crown (for which read HMRC - the UK tax authority), was...

December 2, 2020

The Annual Investment Allowance: a one-off opportunity

You can currently deduct the full value of an item that qualifies for annual investment allowance (AIA) from your profits before...

September 23, 2020

Autumn Budget Cancelled

It was announced yesterday evening (23 September 2020) that the Chancellor, Rishi Sunak has cancelled plans for a Budget this...

September 9, 2020

Remuneration Trusts Targeted by HMRC

HMRC have published Spotlight 56 entitled Disguised remuneration: tax avoidance by owner managed companies using Remuneration...

September 9, 2020

Capital gains tax hikes and pension saving changes anticipated in Autumn Budget 2020

The date for the forthcoming Autumn Budget has not yet been set, but all signs are pointing towards tax increases being announced...

August 26, 2020

HMRC sets its sights on individuals with overseas assets / income

In recent weeks HMRC have recommenced a campaign which targets taxpayers that have overseas assets, income and gains, which may...

July 7, 2020

Mini-Budget Introduces Immediate Measures to Boost the UK’s “Post-Covid 19 Economy”

The Chancellor has today introduced new financial measures in a mini-budget aimed squarely at creating job placements for the...

June 16, 2020

Coronavirus extension granted to claim 3% SDLT relief on replacement of main home

When purchasing a second home, owners are compelled to pay an additional 3% stamp duty land tax (SDLT) on top of the normal SDLT...

May 17, 2020

HMRC win case on in specie contributions to a SIPP

HMRC have won the latest stage on a long running case into the availability of tax relief for contributions made in specie to...

May 11, 2020

Coronavirus is a “reasonable excuse” for failing to meet tax obligations

HMRC has updated their guidance to include Coronavirus in the list what constitutes a “reasonable excuse” for failing to meet...

April 29, 2020

Streamlined Filing Compliance Procedures

The US is one of the few countries in the world to tax their citizens not on their US residency status but on their citizenship....

April 29, 2020

Jamie Favell - Podcast

Jamie Favell, our Private Client Tax Partner talks to Mark Zoril on a Plan Vision podcast discussing the tax issues facing UK...

April 23, 2020

COVID-19 and Foreign Earned Income Exclusion

Many US taxpayers residing overseas make use of the Foreign Earned Income Exclusion (FEIE) when filing their US tax returns. To...

April 22, 2020

IRS relief non US citizens stranded in the United States

With the rapid spread of Covid-19 many countries including the United States responded by restricting travel and imposing...

April 2, 2020

Changes to paying Capital Gains Tax on UK Property Disposals

From 6th April 2020 payment deadlines for Capital Gains Tax when disposing of a UK residential property are changing. Currently,...

March 30, 2020

IRS Economic impact payments

As a part of the US response to the ongoing Covid-19 pandemic, the Treasury Department and the Internal Revenue Service has...

March 24, 2020

Tax Day is now July 15

The Treasury Department and Internal Revenue Service have announced that the federal income tax filing due date is automatically...

March 20, 2020

Some practical tips for business leaders reacting to Covid-19

I think it is fair to say that we are in unprecedented times. Today’s business and economic environment has a very different feel...

March 19, 2020

UK Tax Residency and the Impact of Covid-19

The world is seeing unprecedented disruption as we try and cope with the outbreak of the latest coronavirus.

March 3, 2020

HMRC Secret Unit to Investigate Family Investment Companies

This is an update to our blog of 3 March 2020 in which we discussed the news that since April 2019 HMRC have had a secret unit...

January 21, 2020

Accidental Americans - Are UK Banks next?!

US persons holding bank accounts outside of the US are ordinarily required to disclose such bank/financial accounts to the...

November 13, 2019

HMRC’s Offshore Investment Fund Letters

It has become evident that HMRC are acting on information received under the Common Reporting Standards (“CRS”) and other...

October 16, 2019

HMRC Requesting Offshore Income & Gains information

As previously discussed here HMRC have been targeting taxpayers who they believe have overseas income and gains, which may not...

August 13, 2019

IRS and HMRC targeting crypto investors

We are finding increasing number of clients are investing in cryptoassets and we are aware that for past tax years there has been...

July 11, 2019

Significant changes to taxation of gains on sale of UK property

Finance Bill 2019-20 confirms expected changes to Private Residence Relief and lettings relief

May 21, 2019

IRS to publish guidance on taxation of cryptocurrencies

The IRS has announced that it will soon publish new detailed guidance on how the cryptocurrencies should be treated for US tax...

May 19, 2019

TAP features in Top Accountancy Firms 2019 list

We are delighted to have learnt today that Tax Advisory Partnership has been officially recognised as a Top Accountancy firm for...

March 14, 2019

Non-Dom’s Targeted by HMRC Policy Paper

While the 2019 Spring Budget was a fairly benign event for private clients, HMRC published a policy paper which is worthy of...

February 14, 2019

HMRC's "Offshore Income or Gains” Letters

HMRC are currently sending out letters to taxpayers requesting more information on overseas income and gains, which may not have...

January 11, 2019

Dual In The Crown: Considering UK and Swiss Dual Resident Status

Our private Client Tax Partner Jamie Favell was recently featured in the ePrivate Client annual feature on Switzerland discussing...

January 9, 2019

Mixed Fund Cleansing: Action Required

To recap, if you are a non-dom living in the UK, certain tax residency milestones can impact your tax status. A £30,000 charge...

December 21, 2018

HMRC publishes guidance on cryptoasset investments

HMRC has recently published guidance for UK resident individuals on the potential liability to UK taxes that may arise on receipt...

December 11, 2018

Update on Tier 1 (Investor) visa program

On Friday 7 December 2018 the UK Government suspended the UK Tier 1 (investor) Visa regime at very short notice. These visas...

December 7, 2018

UK Investor visa regime suddenly suspended

This article has been superseded by a government U-turn, follow this link for further information.

October 29, 2018

Budget 2018 – summary of key tax announcements

The Chancellor of the Exchequer today announced his final post-Brexit budget. From a personal tax perspective, the Budget...

September 18, 2018

Complexities of divorce involving a US Citizen and a non-US Citizen

Divorce is a very stressful time but the complexities of the US tax rules when a non-US spouse is involved add an additional...

September 11, 2018

Sick as a Parrott

Former Rangers players and staff paid through an offshore trust have been told they have weeks to approach HMRC over a...

August 8, 2018

Who has a requirement to correct?

It has been well publicised by ourselves, the press and HMRC that the ‘requirement to correct tax due on offshore assets’...

July 16, 2018

Playing a Let

Rent-a-room is a tax relief available individuals who let out a room/s in their home whilst occupying the property at the same...

July 15, 2018

Visa Go Go!

It has been reported in the papers that there has been a sharp rise in applications for the UK’s £2M Tier 1 (Investor) Visa.

July 10, 2018

US Passport denied due to unpaid taxes

Future passports applications will be at risk of being denied due to unpaid taxes, affecting thousands of Americans. Details have

July 9, 2018

Overseas workdays relief – Expat Tax Back

Overseas Workdays Relief (OWDR) is a valuable tax relief available to non-UK domiciled taxpayers, which exempts employment...

July 5, 2018

IRS issues draft form 1040 for 2018 Returns

The IRS recently released a draft of its new Form 1040 that every American taxpayer will use to file their 2018 tax returns...

July 2, 2018

EBTs, Contractor Loans and HMRCs Settlement Offer

Freelance workers must declare any tax-avoidance schemes they have used by 30 September or face punitive penalties.

July 2, 2018

Tax Dual Resident : being tax resident in two places at the same time

It is becoming more and more common for expat workers to commute from their home country to another country where they spend...

February 28, 2018

TAP Year-End Tax Tips

Please click here for our 2017/18 year end personal tax planning tips.

February 23, 2018

Non-Dom Tax Planning Update

If you are a non-dom living in the UK, certain tax residency milestones can impact your tax status.

February 23, 2018

Requirement to Correct : Cleaning up any offshore tax issues

Finance (No. 2) Act 2017 introduced new Requirement to Correct (RTC) legislation which is targeted at non-complicance in respect...

February 22, 2018

TAP Advise on Feel Good Group Private Equity Deal

Russ Cahill our Corporate Tax Partner advised on the recent Feel Good Group / Perwyn private equity deal providing providing tax...

December 5, 2017

Mixed Fund Cleansing

We have assisted several clients with mixed fund cleansing already and now outline here how we have helped one particular client.

September 27, 2017

Non-Dom Changes and Opportunities

This year’s General Election resulted in a period of uncertainty for non-UK domiciled ("non-dom") taxpayers as anticipated tax...

September 12, 2017

Cryptocurrency, Bitcoins and Tax

The press often includes articles about cryptocurrency and bitcoin's – perhaps discussing their future, fluctuating values and...

September 3, 2017

No more offshore

We anticipate that the Finance (No.2) Bill will be passed through to Parliament early this Autumn. Much of the Bill is concerned...

August 1, 2017

Welcome relief?

We have seen various Press articles of late highlighting the plight of those drawing on their pensions, and suffering...

July 31, 2017

"Stat's Entertainment!" : Creative Industry Tax Relief

HMRC released the latest statistics on the number of productions made in the UK claiming tax relief and the amounts of UK and...

July 12, 2017

Mixed Fund Cleansing and Rebasing for Non-Doms - Effective from 6 April 2017

A written statement from the treasury has today confirmed that new tax laws withdrawn from Finance Bill 2017 will be legislated...

July 3, 2017

Non-dom paralysis

Uncertainty continues to abound regarding the status of the changes to the taxation of non-domiciled taxpayers, originally...

June 19, 2017

Non-Resident Capital Gains Tax Penalties

Since April 2015, non-UK residents selling a UK residential property have been required to report the disposal to HMRC within 30...

June 19, 2017

FEU Tax at Edfringe is no joke!

"This blog considers the tax position for foreign entertainers in the UK and the special rules we have, often known as FEU Tax."

June 13, 2017

UK - UAE Double Tax Treaty

We have many clients who have moved to the UAE and specifically Dubai in recent years, many of whom are pleased to know that the...

May 7, 2017

Offshore penalties and Tax Evasion

HMRC are continuing to increase the number of tools available to tackle offshore evasion and are taking an increasingly...

May 3, 2017

Discrimination Settlements and Tax

You work hard for your employer, however throughout your employment you are discriminated against, due to your age and...

April 26, 2017

White House Reveals Tax Plans

Yesterday President Trump revealed plans to significantly cut the tax rates for both individuals and businesses. There are few...

April 6, 2017

UK Property and Non-Resident Capital Gain Tax

We advise non-resident clients on how to manage their UK capital gains tax (CGT) position. Individuals who are not resident in...

April 6, 2017

D Day is here for non-domiciled taxpayers..

The 2016/17 tax year has ended and the key elements of HMRC's Non-Dom reform are now in force.

March 24, 2017

Non-Dom Reforms

Many changes to the taxation of Non-Domiciled ("Non-Doms") taxpayers will take effect from 6 April 2017.

March 24, 2017

ATED - File from 1 April to avoid penalty charges and claim relief...

The annual tax on enveloped dwellings (ATED) has been in place since 2013.

March 2, 2017

Rebasing and Cleansing Mixed Funds

From 6 April 2017, a non-domiciled individual who has been UK tax resident in at least 15 of the previous 20 UK tax years will...

March 2, 2017

2017 Year End Tax Tips

With another filing deadline now behind us, it is time to turn our attention to identifying opportunities which can help reduce...

February 6, 2017

The Art of Tax : Averaging for Creators of Literary or Artistic Works

If you are an author or artists, managing your cash flow and keeping your tax liabilities down is crucial.

January 18, 2017

TAP Advise on Private Equity Deal

Russ Cahill our Corporate Tax Partner advised on the recent Business Growth Fund (BGF) / Ultra Finishing private equity deal...

December 16, 2016

IHT on UK residential property – look through to the future

Changes to the inheritance tax (‘IHT’) treatment of UK residential property were originally proposed in the Summer Budget 2015,...

November 24, 2016

(the last) Autumn Statement

The new Chancellor of the Exchequer, Philip Hammond, today delivered his first, and last, Autumn statement.

November 9, 2016

President Donald J. Trump - What tax changes can we expect?

This morning, Donald J. Trump won the US Presidential Election.

November 9, 2016

US Election Results : Are you now considering expatriation?

Prior to the US Presidential election we heard comments first hand and in the press from US citizens and green card holders that...

October 19, 2016

Non-Dom Reform : Cleansing Offshore Mixed Funds

From 6 April 2017 any individual who has been resident in the UK for at least 15 of the past 20 tax years will be deemed UK...

October 19, 2016

Non-Dom Reform : Rebasing of Assets

From 6 April 2017 any individual who has been resident in the UK for at least 15 of the past 20 tax years will be deemed UK...

October 17, 2016

Keep FIC in the Family

If you have fully utilised your pension saving allowances, exhausted your trust planning opportunities but still want to be able...

October 6, 2016

TAP Advise on Private Equity Deal - Russ Cahill

Russ Cahill our Corporate Tax Partner advised on the recent WHP Facilities private equity deal providing providing tax advice to ...

September 8, 2016

Exchange Rate Fluctuations for US Persons

Carmen Lee from our US tax team has had a article published in The American magazine, covering the issues faced by US Persons...

September 7, 2016

Expat Tax Break : Overseas Workdays Relief

If you are an expat coming to the UK to work there is one UK tax break which should not be ignored...

September 1, 2016

HMRC's Worldwide Disclosure Facility (WDF)

(Updated 18th June 2019) HMRC are busy collecting data from over 100 countries and their financial institutions on UK resident...

August 30, 2016

TAP Advise On Propercorn Private Equity Deal

Russ Cahill our Corporate Tax Partner advised on the recent Propercorn Private Equity Deal providing providing tax due...

August 22, 2016

Oil & Gas Workers

We have many client’s who leave the UK to work in the Oil and Gas Industry.

August 22, 2016

The UK beneficiaries of an Offshore Trust

Our client is an offshore trust which holds a 100% shareholding in an offshore investment company, which held reserves of income...

August 22, 2016

The MBA Graduate

Our client, a non-domciled expat, had recently started a new role with a UK employer following completion of his MBA at a...

June 23, 2016

It was good to know EU

So as we all now know, in a historic referendum the UK has voted with its feet and decided to leave the EU.

April 5, 2016

Annual Tax on Enveloped Dwellings

Act now in order to meet this month’s filing deadline We are assisting our clients in making their ATED declarations for the...

March 21, 2016

Mortgage Interest Relief Restricted for Landlords

The Chancellor confirmed in the Autumn 2015 budget that with effect from 6 April 2017, tax relief on interest relating to...

March 17, 2016

2016 Budget Summary

Yesterday, George Osborne delivered what we consider to be a positive 2016 Budget.

March 1, 2016

Will the IRS Audit my return?

Will my returns be audited by the IRS? It is a question asked of us many times throughout tax season.

February 29, 2016

April – A Taxing Month

In our latest article for The American magazine we discuss some tax tips ahead of the end of the UK tax year and the first...

February 11, 2016

TAP Tax Tips

With another filing deadline now behind us, it is time to turn our attention to identifying opportunities which can help reduce...

February 11, 2016

Employment Tax – Year End Compliance and Planning Opportunities 2015/16

Click here to download our 2015/16 Year End Compliance and Planning note

February 10, 2016

US expatriation on the BBC

You may have seen an article on the BBC website reporting on the record number of Americans relinquishing their US Citizenship...

January 20, 2016

Important tax changes to members’ voluntary liquidations

From 6 April 2016 the Government is making major changes to the way in which certain distributions from companies in members’...

December 22, 2015

Non-US Funds and “Stocks and Shares” ISAs

In our latest article for The American magazine we discuss non-US funds and “Stocks and Shares” ISAs.

December 4, 2015

Scottish Rate of Income Tax (“SRIT”)

The Scottish Rate of Income Tax (“SRIT”) will commence on 6 April 2016 and applies to individuals who reside in Scotland. The...

November 26, 2015

Autumn Statement 2015

The Chancellor of the Exchequer, George Osborne, delivered his first Autumn statement as the Chancellor of a Conservative...

November 24, 2015

Let property campaign

HMRC continue to invest in measures to prevent tax avoidance and evasion and are running campaigns to encourage individuals to...

October 30, 2015

Year-end tax planning for US taxpayers

In our latest article for The American magazine we highlight some great year-end tax planning opportunities for US taxpayers.

October 13, 2015

Pension Contributions – there’s still time!

The amount of an individual’s pension contributions which will qualify for higher-rate tax relief is essentially restricted by:

October 1, 2015

Non-dom story goes on...

As expected, the has Treasury released its consultation document on the forthcoming changes to the taxation of non-domiciled...

September 27, 2015

Penalty Suspensions

Careless inaccuracies The recent case of a self-employed locum pharmacist Mr Bharat Patel TC04617: BHARAT PATEL [2015] UKFTT 445...

September 24, 2015

Non-Residents, Non-Doms, UK Property

UK Government “ATED” those tax reliefs The UK and in particular London has enjoyed phenomenal increases in property values in...

September 1, 2015

EIS Relief – No income, no exemption

The FTT dismissed the tax payer’s appeal against HMRC’s decision not to allow a capital gains tax exemption claimed in respect...

August 17, 2015

HMRC Target Taxpayers with ‘Badges of Wealth’

HMRC have set up a task force focused on collecting tax from Scottish taxpayers who appear to be living beyond their means. They...

August 5, 2015

Out of time rebate claims - Higgs v HMRC

A taxpayer wins case to claim a repayment exceeding the 4 year limit Mr Higgs made payments on account for the tax year 2006/07...

July 7, 2015

Budget 2015: TAP Private Client Update

The Chancellor of the Exchequer, George Osborne, delivered the first Conservative Budget since 1996 today.

July 5, 2015

A long time in the making

Taxpayer wins landmark LLC case The Supreme Court has allowed the taxpayer's appeal in Anson (formerly Swift) v HMRC, which has...

June 22, 2015

Capital Gains Tax Charge on Non-Residents

Individuals who are not resident in the UK are generally exempt from capital gains tax (CGT) on gains made on the disposal of...

June 21, 2015

UAE and US Sign FACTA Agreement

The UAE and US have signed an agreement to implement America’s Foreign Account Tax Compliance Act (FATCA). Under this agreement...

June 9, 2015

Are you an American?

And why you might not want to read this blog if you think you may be. Holding a US passport means enjoying the benefits of...

May 9, 2015

The French Musician

Our client, a successful French recording artist, is a US resident taxpayer. In 2022 she performed on a short tour of the UK...

May 9, 2015

The Overseas Investor

Our client, a non-UK domiciled individual, has lived in the UK for a number of years. Initially, his “non-dom” status allowed...

May 9, 2015

The Non-Domiciled Private Equity Advisor

Our recent work for a client provides some good examples of planning which can be considered for a UK resident but non-UK...

May 9, 2015

The Private Practice Surgeon

A number of our clients work in the medical profession, and self-employed consultants in particular, will invariably require...

May 9, 2015

The Investor Visa

We often advise individuals who are moving to the UK on how to structure their financial and business affairs in a tax efficient...

March 10, 2015

TAP Client Survey 2014

The TAP ethos is to provide efficient and exceptional client service.

March 10, 2015

TAP Year End Tax Tips 2014/15

With another filing deadline now behind us, it is time to turn our attention to identifying opportunities which can help reduce...

February 27, 2015

UK property and mortgage exchange rate gains

The nasty smell at the back of your mortgage The London housing market is booming again and inevitably this results in homes...

February 27, 2015

Employment Taxes

Year End Compliance and Planning Opportunities – 2014/15 Listed below are some of the key compliance areas and opportunities...

January 28, 2015

Missing something?

Bigger and better Despite initial concerns that Research and Development Tax Reliefs might only survive as long as the Labour...

December 5, 2014

Patent Box

Where are we after the Autumn Statement? With newspaper headlines variously describing Patent Box as dead, alive or in a state...

December 4, 2014

Improvements to the UK's R&D Tax Relief regime

Several improvements to the UK's R&D Tax Relief regime were announced in yesterday's Autumn Statement.

November 28, 2014

Capital Gains Tax for Non-Resident Owners of UK Residential Property

It is widely known that from 6 April 2015 a new capital gains tax (“CGT”) regime will apply to non-resident owners of UK...

November 20, 2014

Deoffshorisation

Changes in Russian Tax Law to Force Migration to UK The Russian government has passed new tax legislation that will force...

November 18, 2014

Patent Box Changes – don’t miss out!

Launched with much fanfare in 2013, Patent Box is a flagship Government policy to promote innovation in the UK economy. Patent...

November 18, 2014

Nowhere to Hide

UK and 51 jurisdictions to share financial account details of resident taxpayers The UK has signed up to a new automatic...

November 12, 2014

Renewals Basis Runs Out

It may have escaped landlords' attention that, as from 6 April 2013, HM Revenue & Customs have withdrawn the ‘renewals basis’,...

October 20, 2014

Business Property Relief on AIM Listed Shares

Investing in companies listed on the Alternative Investment Market (AIM) is often seen as an attractive prospect from an...

October 19, 2014

Thinking inside the Patent Box?

A tax policy for innovation Research and development involves significant risk and cost and even a successful technical outcome...

October 15, 2014

Negative Earnings

It is not unusual for an employee to receive a valuable signing on bonus, often referred to as a ‘golden handshake’ in exchange...

October 15, 2014

TAP Grows Corporate Tax Team

Tax Advisory Partnership (“TAP”), the specialist tax services firm with offices in Leeds and London, is set for further...

October 7, 2014

Non-Dom Campaign Reaps Rewards for HMRC

A report in this weekend’s Financial Times highlighted that HMRC have collected £154M following investigations into ‘high-income...

September 24, 2014

International tax developments

Embracing the global economy In an increasingly global marketplace, governments around the world are focussing on where profits...

September 21, 2014

Property Taskforce

A new property taskforce has been launched by HMRC to tackle “taxpayers” who are not declaring property income in North West...

August 18, 2014

I didn’t EXPAT that...

If you are a British Expat or a non-resident UK tax payer you will have no doubt seen the news headlines in recent months:

August 18, 2014

LDF Update

Liechtenstein and the UK have signed a fourth joint statement updating the Liechtenstein Disclosure Facility (LDF). Our previous...

August 4, 2014

On Borrowed Time

HMRC have withdrawn an important concession regarding the use of loans in the UK which are backed by non-UK assets.

July 22, 2014

Off-target

HMRC’s Let property campaign, overseas bank accounts and low effective tax rates HMRC are stepping up their campaign trail to...

July 14, 2014

Foreign mortgage exchange rate gain

The nasty smell at the back of your mortgage

The housing market is moving again and this will inevitably result in an increase...

July 14, 2014

Know your options

HMRC are set to make a small but important change to the taxation of share options awarded to internationally mobile employees...

July 14, 2014

Unstable home? CGT for non-residents update...

It has been interesting to keep abreast of various responses to the proposed capital gains tax charge on non-UK residents over...

July 14, 2014

Accelerated Payments & Follower Notices

Overview of the proposals Whilst most in the tax profession may have viewed as inevitable from early this year when the...

July 14, 2014

Nothing to Declare

The Liechtenstein Disclosure Facility (LDF) is an agreement entered into between the governments of Liechtenstein and the UK...

May 13, 2014

Exercising options: Expats beware!

HMRC are set to make a small but important change to the taxation of share options awarded to internationally mobile employees...

April 10, 2014

The April 15 Tax Deadline

With April 15 looming, the initial deadline for US people to pay their taxes, we take a look at why so many Americans are saying...

March 27, 2014

TAP continues expansion

The fast growing Tax Advisory Partnership has made a hat-trick of announcements in the space of less than a week.

March 20, 2014

Accelerated payment of tax

Whilst these changes were announced in the Autumn Statement and subsequent consultation document, it was hoped the proposals...

March 19, 2014

Budget 2014 – #Makers-Doers-Savers

The Chancellors’ 2014 Budget speech focused on delivering a message of a UK economy growing at a faster rate than any other...

March 13, 2014

Using pension arrangements in your business

It is often forgotten that pension funds can offer an alternative and tax efficient solution to buying commercial property.

March 13, 2014

Employers: no time to rest

As employers face their first year of filing under RTI we look at what needs to be done and highlight some of the other actions...

March 13, 2014

TAP Tax Policy

The 2014 Budget is now less than a week away, and with increasing messages of improvement in the British economy and the General...

March 13, 2014

Year-End Tax Planning: Key Strategies Before 5 April 2014

It is time to turn our attention to maximising the efficiency of your tax affairs in the lead up to 5 April 2014. Below are a...

March 12, 2014

Budget Day is coming...

It has been announced by the Treasury that, following The Chancellor’s Budget Statement on Wednesday 19 March, the 2014 Finance...

February 25, 2014

New 3.8% Net Investment Income Tax Now in Effect for 2013

The net investment income tax is a new tax charged at a flat rate of 3.8% which will apply for the first time on Federal income...

February 6, 2014

Non-doms not deterred

As recently reported in the FT, the levy on non-domiciled individuals raised £178m for the UK exchequer for the 2011-12 tax...

February 3, 2014

Cayman Get It: HMRC target taxpayers with financial assets on the Island

Following the automatic tax information exchange agreement between the UK and the Cayman Islands, signed on 5 November 2013,...

January 16, 2014

What a Relief – Tax Mitigation for Expats

UK tax rules applying to UK non-dom’s and expatriates have been subject to significant change since 6 April 2008. These changes...

January 16, 2014

Partnership Profit Allocations: All Mixed Up

It was announced in the 2013 Budget that a consultation document would be published, which focused on two main aspects of...

January 16, 2014

Autumn Statement 2013: Key Tax Changes and What They Mean for You

With the festive season behind us, we have had time now to reflect on the Chancellor's Autumn Statement, which now seems to fall...

January 8, 2014

London Property Market On The Up

It has been reported in today’s press that London now surpasses New York as the leading city for property investment for foreign...

January 6, 2014

ATTENTION / ACHTUNG / ATENCIÓN / UPPMÄRKSAMHET / Помните / ATTENZIONE / ATENÇÃO !!!!

2012/13 UK TAX RETURNS & LATE FILING PENALTIES This article centres around 2 key questions:

December 20, 2013

Tax Implications on Redundancy/Termination Pay: foreign service relief

It is always disappointing to hear news of redundancies, but sadly the likes of Reuters and Barclays have announced some fairly...

December 5, 2013

Autumn Statement Update: Key Tax Announcements and Upcoming Changes

Today saw the Chancellors Autumn Statement, which now seems to fall traditionally in early December!

November 15, 2013

Breaking news: Capital Gains Tax Charges for Non-Resident Owners of UK Real Estate

Following the introduction of new laws in Finance Act 2013 regarding the ownership of UK real estate in a corporate vehicle, it...

November 15, 2013

EIS Planning: From the Cradle to the Grave

As you may know the landscape for personal tax planning has changed significantly since the introduction of the General Anti...

November 15, 2013

A BIR’d in the Hand

Or how to remit and make free investments The difference in the way the UK taxes its own citizens and non-UK domiciles...

November 15, 2013

Eurobonds; what’s all the fuss about?

A national newspaper has recently run a series of articles that highlight the perceived abuse of a tax exemption involving many...

November 7, 2013

UK Income Tax Reliefs ‘For the Class of 2013’

If you have recently started a new role with a UK employer following completion of your under graduate, and/or post graduate...

October 31, 2013

File on time and avoid penalties!

It was reported in today’s FT that HMRC issued 915,000 penalties for late filed 2011/12 Tax Returns. This is likely to have...

October 28, 2013

Eurobonds; what’s all the fuss about

A national newspaper has this week run a series of articles that highlight the perceived abuse of a tax exemption involving many...

October 24, 2013

Let Property (Rental Income) HMRC Amnesty

What is it Some readers may be aware of recent press announcements by HMRC in connection with the up and coming buy to-let...

October 7, 2013

Do your taxes need a health check?

HMRC have launched a tax amnesty for health professionals to disclose undeclared income.

September 11, 2013

The Net Investment Income Tax: What High Earners Need to Know

The net investment income tax, which applies for the first time from Jan 1 2013, imposes a rate of 3.8 percent to certain net...

September 5, 2013

Changing Attitudes towards DOMA

In June the Supreme Court heralded the way for change. The Defense of Marriage Act (DOMA) was deemed unconstitutional;...

September 3, 2013

Finance Act round-up

The Finance Act passed into law as expected on 17 July 2013, and is perhaps best summed up as an anti-avoidance bill. There are...

September 3, 2013

Partnership Condoc: Breaking up is hard to do

As announced in the 2013 Budget, the Government is consulting on changes to two aspects of the partnership tax rules.

September 3, 2013

Taxing by citizenship - a much needed break by the IRS?

The IRS has recently introduced the Streamline Voluntary Disclosure programme. This scheme has been offered as something akin to...

September 3, 2013

Home is Where the Charge is

The Annual Tax on Enveloped Dwellings or “ATED” regime is now upon us, and could end up being a first step towards a so-called...

August 12, 2013

US citizens and green card holders renouncing citizenship

As reported in the Wall street Journal last week, figures show the number of US citizens renouncing their citizenship is on the...

August 11, 2013

Non-doms in the spotlight

As recently reported in the FT*, those claiming non-domicile status in the UK may well receive a letter from HMRC gently...

August 7, 2013

A Gift Horse...

HMRC have again intimated that they are comfortable with the concept of so-called "Discounted Gift Trusts" which can be used as...

May 28, 2013

Foreign Account Tax Compliance Act (“FATCA”) Update

Draft forms received The IRS has received for public comment, draft versions of three forms which will be required in the...

May 24, 2013

Filing your Report of Foreign Bank Accounts

Form TD 90-22.1 FBAR This is a reminder that, the deadline for filing the 2012 Report of Foreign Bank Accounts (FBAR) is 28 June...

May 19, 2013

June 17 - Time for those abroad to file their taxes!

For US citizens and resident aliens residing overseas the due date for tax filing is fast approaching.

May 13, 2013

Overseas Workdays Relief – HMRC updated guidance

HMRC have issued revised guidance on the Statutory Residence Test and the operation of Overseas Workdays Relief (OWR) in this...

April 2, 2013

Close companies - loans to participators

Background The headlines are full of new and extended tax reliefs for SMEs and employee owned businesses, but one area that...

March 28, 2013

Property Sales Campaign

A new disclosure facility has been launched by HMRC, the Property Sales campaign.

March 21, 2013

Budget 2013: No alarms and no surprises?

There was little in this year’s Budget which had not already been leaked in the press it would seem. However, the devil as always...

March 12, 2013

Isle of Man to share information with HMRC

Isle of Man / UK Tax Agreement and Disclosure Opportunity As anticipated the Isle of Man (IOM) has signed a tax agreement with...

March 5, 2013

Can I have my tax back please?

If you believe you have overpaid tax or missed claiming some relief in an earlier year then you should reclaim this from HMRC...

March 4, 2013

Oh no... I haven’t filed my US tax returns

A guide to coming clean to the IRS and getting up to date with your taxes Fix it, fix it quickly, and don’t do it again. That’s...

February 12, 2013

Is there Devil in the Detail?

Further to our previous article we now have the full draft legislation which will apply the new Annual Residential Property Tax...

January 3, 2013

American Taxpayer Relief Act of 2012 signed by President Obama

The largely anticipated “American Taxpayer Relief Act of 2012” was signed in to Law by President Obama on 2 January 2013.

December 12, 2012

Taxing Problem for High-Value Property

As expected, the Finance Bill released yesterday revealed details of the new Annual Residential Property Tax which is to apply...

December 11, 2012

Isle of Man to share clients bank information with the UK

A deal has been made with the Isle of Man which will see details of bank accounts held on the Island revealed to HMRC, under the...

December 5, 2012

Much Ado About Nothing

This year’s Autumn Statement turned out to be particularly non-eventful from a tax perspective.

November 16, 2012

HMRC turn up the heat

HMRC are busy reminding taxpayers with Swiss accounts that they only have until 1 January to make a full disclosure of their...

November 9, 2012

JP Morgan EBT - settlement with HMRC draws closer...

As has long been suspected, JP Morgan have been in talks with HMRC to settle their protracted dispute concerning the bank's EBT...

November 9, 2012

Whistleblower reveals offshore HSBC accounts

According to a report in the Daily Telegraph, HM Revenue and Customs (HMRC), the UK tax authorities, have obtained details of...

November 5, 2012

Tap in the Press!

Heather considers how the abolition of Extra Statutory Concession C16 (which allowed certain business owners to wind up their...

October 23, 2012

Avoid late filing and payment penalties

It was well publicised that HMRC expected a windfall of up to £600 million as a result new late filing rules introduced last...

September 26, 2012

Pension annual allowance charge

The annual allowance rules which took effect from 6 April 2011 lowered the maximum annual amount that an individual can...

August 14, 2012

A Harsh Climate - HMRC windfall from new penalties

HMRC have announced a massive £600million windfall from individual taxpayers failing to submit their 2010-11 tax returns on...

July 31, 2012

Reform of UK anti-avoidance rules

It is often said that the UK’s current anti-avoidance rules for “offshore” structures are inconsistent with EU law, and it comes...

July 18, 2012

Going global

The majority of businesses now have an international context to their operations. This may comprise simply of having suppliers...

July 16, 2012

A long time coming... changes to IHT for trusts?

In a welcome move, HMRC have entered into a consultation process concerning the inheritance tax (IHT) regime for trusts. This is...

July 9, 2012

U-Turn on French Wealth Tax

As was widely expected, the change in government in France has led to various changes to the French tax system, not least to the...

July 8, 2012

Rental fun and (Olympic) games!

So you’ve secured your tenant, renewed your Gas Safety Certificate (I hope!) and organised your alternative accommodation as of...

July 5, 2012

UK Tax Residence, any clearer?

At present, an individual’s UK tax residence position is based on some limited statutory rules and a wealth of case law,...

July 4, 2012

Is a single European tax regime inevitable?

Tax authorities across Europe continue to press ahead with the integration of tax regulations. A recent announcement by the EU...

July 3, 2012

File your old tax returns now to avoid large penalties

HMRC's latest campaign the 'Tax Return Initiative', was launched on 3 July, aimed specifically at higher-rate taxpayers who have...

June 25, 2012

TAP in the Press!

Heather Miller has been published again in Taxation magazine – Click here to read her double feature on buying and selling a...

May 9, 2012

SEIS - tax incentives for seed capital

In a welcome move from the Treasury, the Seed Enterprise Investment Scheme (SEIS) came into force on 6 April 2012. In essence,...

March 22, 2012

Budget 2012 – How does it affect you?

While there were some surprises in the Chancellor’s speech, a lot was widely predicted in advance and the usual story of...

March 19, 2012

Pensions - Make your fixed protection pension claim by 5 April 2012?

The lifetime allowance is the maximum value a pension fund can be at your nominated retirement date without the excess being...

March 6, 2012

Budget Day is coming - time to top up your pension?

In the absence of a crystal ball, there is no way of knowing for sure how tax relief will be affected by the upcoming Budget on...

March 2, 2012

TAP Year End Tax Tips (2011/12)

As the 5th April approaches it is time to review your affairs and explore some of the opportunities available to reduce your UK...

December 9, 2011

TAP in the Press! Taxation Magazine

Heather Miller, our new tax consultant, has been published this week in Taxation magazine – click here to read her article on...

November 30, 2011

2010/11 TAP TAX SURGERIES!

Changes to HMRC’s penalty regime mean that taxpayers who submit their 2010/11 Tax Return late, face far heftier fines than ever...

November 30, 2011

Autumn Statement - New "Seed Enterprise Investment Scheme" (SEIS)

Inevitably, the main focus of the Chancellor's Autumn Statement was the state of the UK's finances and the outlook for future...

November 10, 2011

Pensions - Don't waste unused tax relief!

Contribute more than £50,000 to your pension in 2011/12 AND get higher rate tax relief As of 6th April 2011, the government...

October 27, 2011

It's Tax Return time, again...

2010/11 Self Assessment Tax Return Filing The economic climate of recent years and austerity measures introduced by the...

October 16, 2011

EIS - EC Approval set to boost UK business and entrepreneurship!

Generous enhancements to the Enterprise Investment Scheme (EIS) were announced in this year’s Budget, however they were subject...

October 12, 2011

HMRC's Tax Catch Up Plan – Make your disclosure by 6th January 2012!

HMRC have launched their second tax amnesty of 2011, this time focusing on the undeclared taxes of tutors and coaches.

August 24, 2011

Swiss tax agreement announced

Swiss tax agreement announced The long-awaited agreement with Switzerland over bank accounts held by UK taxpayers has now been...

July 19, 2011

Business Structuring

TAP INTO TAX Iss. 3 The purpose of this series of blogs is to highlight innovative tax planning ideas, which you can ‘TAP’ into;...

July 5, 2011

E-marketplace trading (or not...)

HMRC have recently announced they will be focusing a new disclosure opportunity at people who use e-marketplaces such as eBay to...

June 22, 2011

Meat on the bones

Treasury reports on Non-Dom consultation Further to the Chancellor’s comments in his March Budget, the Treasury has released its...

June 19, 2011

Crystal clear?

Treasury releases details of new Statutory Residence Test We now have a first look at the long-awaited statutory test for...

June 14, 2011

Tax breaks for ex-pats working in the UK

TAP INTO TAX Iss. 2 The purpose of this series of blogs is to highlight innovative tax planning ideas, which you can ‘TAP’ into;...

May 22, 2011

University Fees Planning

TAP INTO TAX Iss. 1 The purpose of this series of blogs is to highlight innovative tax planning ideas, which you can ‘TAP’ into;...

May 12, 2011

HMRC 'Tax Dodge Task Force'

HMRC has announced the launch of new task forces to tackle ‘tax dodgers’ (their words not ours!). This announcement comes a...

May 3, 2011

HMRC Clampdown on Swiss Bank Accounts

As part of their ongoing efforts to tackle tax evasion, HMRC have announced a new strategy targeting individuals with Swiss bank...

April 20, 2011

French Tax Reforms

Trouble ahead for non-residents owning property in France? The Sarkozy government in France has announced various tax reforms...

April 17, 2011

Taxpayers Encouraged by HMRC to File Tax Returns On Time...

To mark the start of a new tax year HMRC have presented taxpayers with a new incentive to file their tax returns on time! New...

April 10, 2011

Non-residence and "Full-time" employment overseas

HMRC show their hand... It has been reported that HMRC have outlined proposals regarding their view on the meaning of...

March 25, 2011

Budget 2011 - style but no substance?

Many readers will have taken a keen interest in the Chancellor’s much vaunted “Budget for Growth” on 23 March. From a tax...

March 23, 2011

New Tax Amnesty - Not just for plumbers!

HM Revenue & Customs (HMRC) have announced a new tax disclosure facility, the Plumbers Tax Safe Plan (PTSP).

November 18, 2010

GAAR: A Step Too FAAR?

One of first taxation related announcements of the new Conservative/Liberal coalition government was that they would start an...

August 10, 2010

To Avoid Tax, Or Not To Avoid Tax, That Is The Question

“Spotlights” is an HM Revenue & Customs’ initiative to warn the public about what they perceive the be questionable tax planning...

June 21, 2010

When you can have your cake but can't eat it

A number of tax avoidance case decisions have made interesting reading, mainly for the wrong reasons. They all focus on Tax...

April 15, 2010

No Tax Reality but a silver lining?

This tax case involves a tax avoidance strategy at its heart, one of the first marketed tax strategies to come before the First...

February 12, 2010

Grays Timber Products Limited vs HMRC

The UK Supreme Court handed down its first unanimous Tax Decision in favour of HMRC in Grays Timber Products Limited v Her...

Subscribe Here!

When blogs are published you can select to receive notifications instantly or receive a summary of published blogs daily, weekly or monthly.

You will have the opportunity to opt out at any time.

To subscribe please enter your name, email address, and preferred frequency below.

.jpg?width=596&name=ai-generated-9045660_1280%20(1).jpg)

.jpg?width=596&name=agriculture-8030874_1280%20(1).jpg)

.png?width=596&name=Untitled%20design%20-%202025-12-01T154146.002%20(2).png)

.png?width=596&name=Untitled%20design%20-%202025-11-26T170308.553%20(1).png)

.jpg?width=596&name=travel-6844908_1280%20(1).jpg)

.jpg?width=596&name=halloween-9926400_1280%20(1).jpg)

.jpg?width=596&name=ai-generated-8894139_1280%20(1).jpg)

.jpg?width=596&name=soccer-488700_1280%20(2).jpg)

.jpg?width=596&name=innovation-561388_1280%20(1).jpg)

%20(1).jpg?width=596&name=big-ben-7116305_1280%20(1)%20(1).jpg)

%20(1)-1.jpg?width=596&name=shutterstock_1775207129%20(2)%20(1)-1.jpg)

.jpg?width=596&name=telescopic-mirror-74034_1280%20(1).jpg)

.jpg?width=596&name=finance-8836902_1280%20(1).jpg)

%20(1).jpg?width=596&name=aircraft-4885805_1280%20(2)%20(1).jpg)

%20(1)%20(2).jpg?width=596&name=pocket-watch-3156771_1280%20(1)%20(1)%20(2).jpg)

.jpg?width=596&name=global-business-9062781_1280%20(1).jpg)

%20(1).jpg?width=596&name=pound-414418_1280%20(1)%20(1).jpg)

.png?width=596&name=Untitled%20design%20(68).png)

.jpg?width=596&name=right-4703922_1280%20(1).jpg)

.jpg?width=596&name=deadline-2636259_1280%20(1).jpg)

%20(2)%20(1).jpg?width=596&name=ai-generated-8155552_1280%20(1)%20(2)%20(1).jpg)

.jpg?width=596&name=connection-4885313_1280%20(1).jpg)

.png?width=596&name=Untitled%20design%20(49).png)

.jpg?width=596&name=ai-generated-8692178_1280%20(1).jpg)

.png?width=596&name=Screenshot%202025-01-08%20144516%20(2).png)

.jpg?width=596&name=under%20the%20sword%20(1).jpg)

.jpg?width=596&name=shutterstock_1690122226%20(1).jpg)

.jpg?width=596&name=shutterstock_1612912039%20(1).jpg)

.jpg?width=596&name=shutterstock_1264398019%20(1).jpg)

.jpg?width=596&name=shutterstock_1155126223%20(1).jpg)

.jpg?width=596&name=shutterstock_1140092966%20(1).jpg)

.jpg?width=596&name=shutterstock_701292883%20(1).jpg)

-1.jpg?width=596&name=shutterstock_605472758%20(1)-1.jpg)

.jpg?width=596&name=shutterstock_1670260216%20(1).jpg)

-1.jpg?width=596&name=shutterstock_11724193%20(1)-1.jpg)