HMRC Success Against Bernie Ecclestone : What does this mean for those of us that aren't billionaires?Its been widely publicised that HMRC have been successful in their criminal investigation of ...

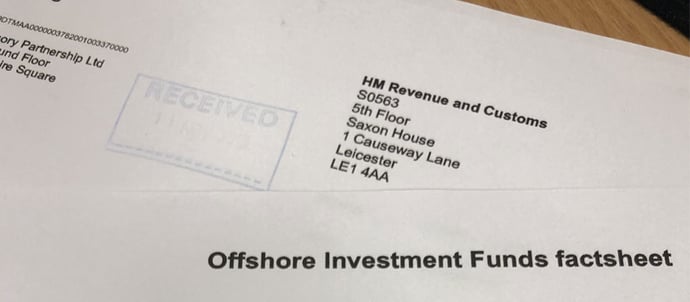

Read MoreHMRC continue to become aware of taxpayers who may be in receipt of income/gains from overseas assets via automatic exchange of information with other countries. This has led to a significant ...

Read MoreWe have been made aware by the Chartered Institute of Taxation that, the UK tax authorities, HM Revenue and Customs (“HMRC”) intend to target offshore companies owning UK property.

Read MoreIt has become evident that HMRC are acting on information received under the Common Reporting Standards (“CRS”) and other information exchange agreements to make contact with taxpayers that they ...

November 13, 2019

by Jamie Favell

in

information exchange

,

overseas assets

,

Worldwide Disclosure Facility

,

non-dom

,

offshore non-disclosure

,

failure to disclose

Read More

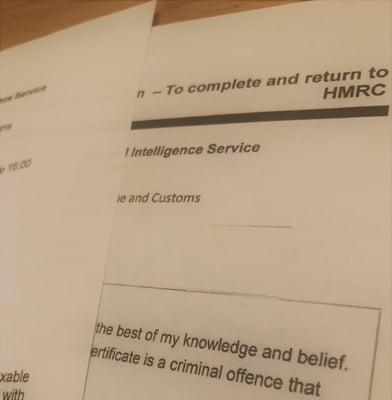

As previously discussed here HMRC have been targeting taxpayers who they believe have overseas income and gains, which may not have previously been disclosed.

October 17, 2019

by Jamie Favell

in

HMRC threats

,

offshore gains

,

overseas assets

,

criminal offence

,

non-dom

,

offshore non-disclosure

,

Offshore Income Gains

,

failure to disclose

Read More