Last year wrote about offshore income and gains letters being issued to taxpayers who were linked to the Pandora Papers. https://blog.taxadvisorypartnership.com/blog/pandora-papers

Read MoreHMRC Success Against Bernie Ecclestone : What does this mean for those of us that aren't billionaires?Its been widely publicised that HMRC have been successful in their criminal investigation of ...

October 13, 2023

by Jamie Favell

in

Current Affairs

,

information exchange

,

overseas assets

,

undeclared

,

criminal offence

,

non-uk trust

,

offshore non-disclosure

,

amend offshore tax

,

failure to disclose

,

HMRC powers

,

evasion

,

expat taxes

Read More

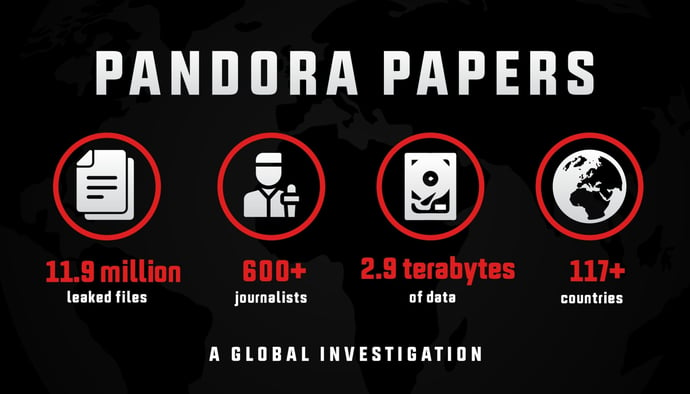

The Pandora papers involved the release of millions of documents from a number of different offshore financial service providers, revealing amongst other financial activities, serious tax avoidance ...

June 27, 2023

by Jamie Favell

in

information exchange

,

overseas assets

,

undeclared

,

200% tax penalty

,

punitive tax penalty

,

evasion

,

Pandora papers

Read More

A recent freedom of information request shows a slight drop in the number of reports of suspected tax evasion made by members of the public and businesses in the last tax year. Unfortunately, it ...

Read More