We advise a lot of clients on their UK tax resident status and also, in cases where they are dual resident, we assist them in determining the country they are tax treaty resident in.

Read MoreIt is being widely reported in the UK press that UK taxpayers are leaving the UK due to the tax changes coming into force from 6 April 2025.

On 29 July His Majesty’s Treasury (HMT) made a request for stakeholders to provide evidence and comments on proposals to reform the taxation of Carried Interest. The Chartered Institute of Tax (CIOT) ...

Read MoreThis article is to make you aware of a new tax alert issued by HMRC which confirms they are targeting those who sell goods and services online.

Read MoreIf you own any crypto assets, it is important that you consider whether any gains realised have been reported correctly as these are now being targeted by the UK tax authorities at HM Revenue & ...

After 14 years of Conservative rule, Labour has taken the reins under Keir Starmer with a massive majority as the electoral map shifted from blue to decisive red on 4 July.

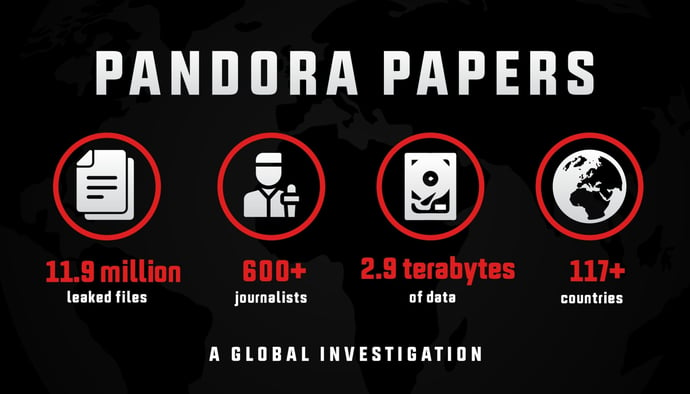

Read MoreLast year wrote about offshore income and gains letters being issued to taxpayers who were linked to the Pandora Papers. https://blog.taxadvisorypartnership.com/blog/pandora-papers

HMRC Success Against Bernie Ecclestone : What does this mean for those of us that aren't billionaires?Its been widely publicised that HMRC have been successful in their criminal investigation of ...

HMRC continue to become aware of taxpayers who may be in receipt of income/gains from overseas assets via automatic exchange of information with other countries. This has led to a significant ...

Read MoreIt is being widely reported in the press that HMRC are targeting individuals that have claimed non-resident status for UK tax purposes during the Covid-19 pandemic.As we well know the pandemic caused ...

Read More