Last year wrote about offshore income and gains letters being issued to taxpayers who were linked to the Pandora Papers. https://blog.taxadvisorypartnership.com/blog/pandora-papers

Read MoreHMRC continue to become aware of taxpayers who may be in receipt of income/gains from overseas assets via automatic exchange of information with other countries. This has led to a significant ...

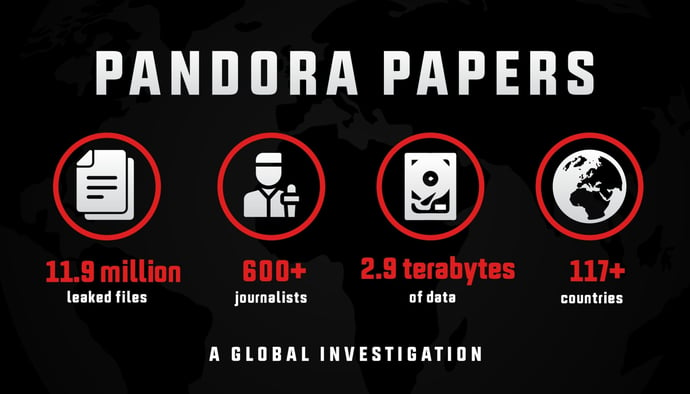

Read MoreThe Pandora papers involved the release of millions of documents from a number of different offshore financial service providers, revealing amongst other financial activities, serious tax avoidance ...

June 27, 2023

by Jamie Favell

in

information exchange

,

overseas assets

,

undeclared

,

200% tax penalty

,

punitive tax penalty

,

evasion

,

Pandora papers

Read More

Companies that own UK property are required to file annual ATED Returns (“Annual Tax on Enveloped Dwellings”) with HMRC.

Read More