Last year wrote about offshore income and gains letters being issued to taxpayers who were linked to the Pandora Papers. https://blog.taxadvisorypartnership.com/blog/pandora-papers

Read MoreHMRC Success Against Bernie Ecclestone : What does this mean for those of us that aren't billionaires?Its been widely publicised that HMRC have been successful in their criminal investigation of ...

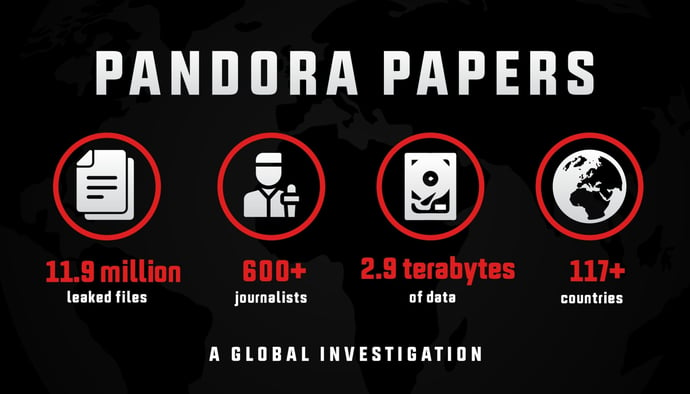

The Pandora papers involved the release of millions of documents from a number of different offshore financial service providers, revealing amongst other financial activities, serious tax avoidance ...

There has been a huge amount of press around the fact that Rishi Sunak’s wife, Akshata Murthy, is a “non-dom” and able to access the “remittance basis of taxation”.In case it isn’t clear this isn’t a ...

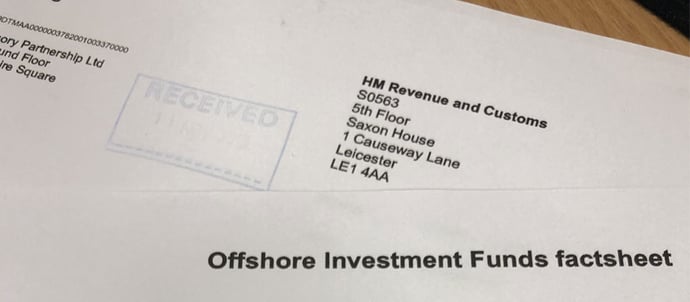

It has become evident that HMRC are acting on information received under the Common Reporting Standards (“CRS”) and other information exchange agreements to make contact with taxpayers that they ...

As previously discussed here HMRC have been targeting taxpayers who they believe have overseas income and gains, which may not have previously been disclosed.

HMRC are currently sending out letters to taxpayers requesting more information on overseas income and gains, which may not have previously been disclosed to HMRC. This letter has been sent because ...